Lender Hub

Configurable workflow and risk management system for the mortgage valuation market

View productWeb based integrated workflow management system for the buy-to-let portfolio market

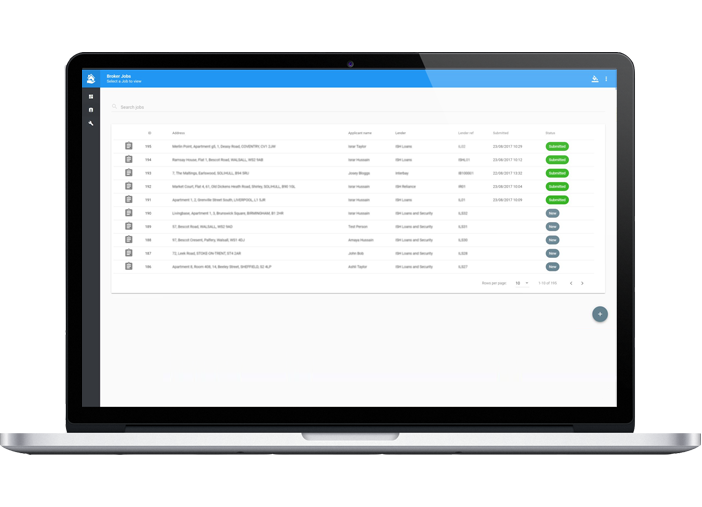

The BTL Hub is a web based desktop platform that helps lenders comply with the Prudential Regulatory Authority’s SS13/16 portfolio landlord underwriting standards. BTL Hub also speeds up the underwriting process and significantly reduces the administrative burden on brokers when submitting buy to let portfolios to lenders.

The BTL Hub allows lenders to configure their own rules around Interest Coverage Ratios and Loan To Value exposure in real-time to reflect risk appetite and exposure levels within their business. The software also provides brokers with the ability to easily import landlord data from multiple spreadsheets, which is automatically verified and converted into lender specific templates before an application is submitted.

...

...

...

For more information about Buy To Let Hub download the brochure, or get in touch with us.

Download brochure Get in touchConfigurable workflow and risk management system for the mortgage valuation market

View productWeb based integrated workflow management system for the surveying and valuation market

View productIntelligent and accurate property valuation estimates, using advanced AVM technology

View productIntelligent and accurate property rental estimates, using advanced AVM technology

View productCatastrophe insights from across the globe to improve understanding of natural hazards

View productFraud detection and prevention tool to identify suspect mortgage loans

View product